Defensive driver courses range from $20 to $100 depending on where you take them and what features they include. The price difference matters because some providers charge extra fees you won’t see upfront.

At floridadetscourse.com, we break down exactly what you’ll pay and where you can find the best deals. This guide shows you how to get quality training without overspending.

What You’ll Actually Pay for a Defensive Driver Course

Online defensive driver courses cost between $14.95 and $96.95, depending on your state. Delaware sits at the lowest end around $14.95, while Wisconsin charges $96.95. Most states cluster in the mid-range with charges between $25-60. Each state sets its own requirements and approves different providers, which explains the variation. Some courses charge one flat fee that covers everything-video content, quizzes, the completion certificate, and digital delivery-with no hidden processing fees or surprise charges. DriveSafe Online maintains a consistent $24.95 price across all course lengths, which means a 1-hour refresher costs the same as a 6-hour comprehensive program. This approach forces you to evaluate what you actually need rather than paying more for length you won’t use.

Online Courses Eliminate Hidden Expenses

Online courses beat in-person classes financially because online providers eliminate overhead costs. In-person driver education can cost several hundred dollars when you factor in instructor fees, facility rental, and scheduling coordination. An online course at $24.95 in Georgia requires nothing but a laptop and internet connection. In-person instruction demands your own vehicle, active insurance coverage, and time away from work or other commitments. The financial payback happens fast because insurance discounts offset the course cost quickly.

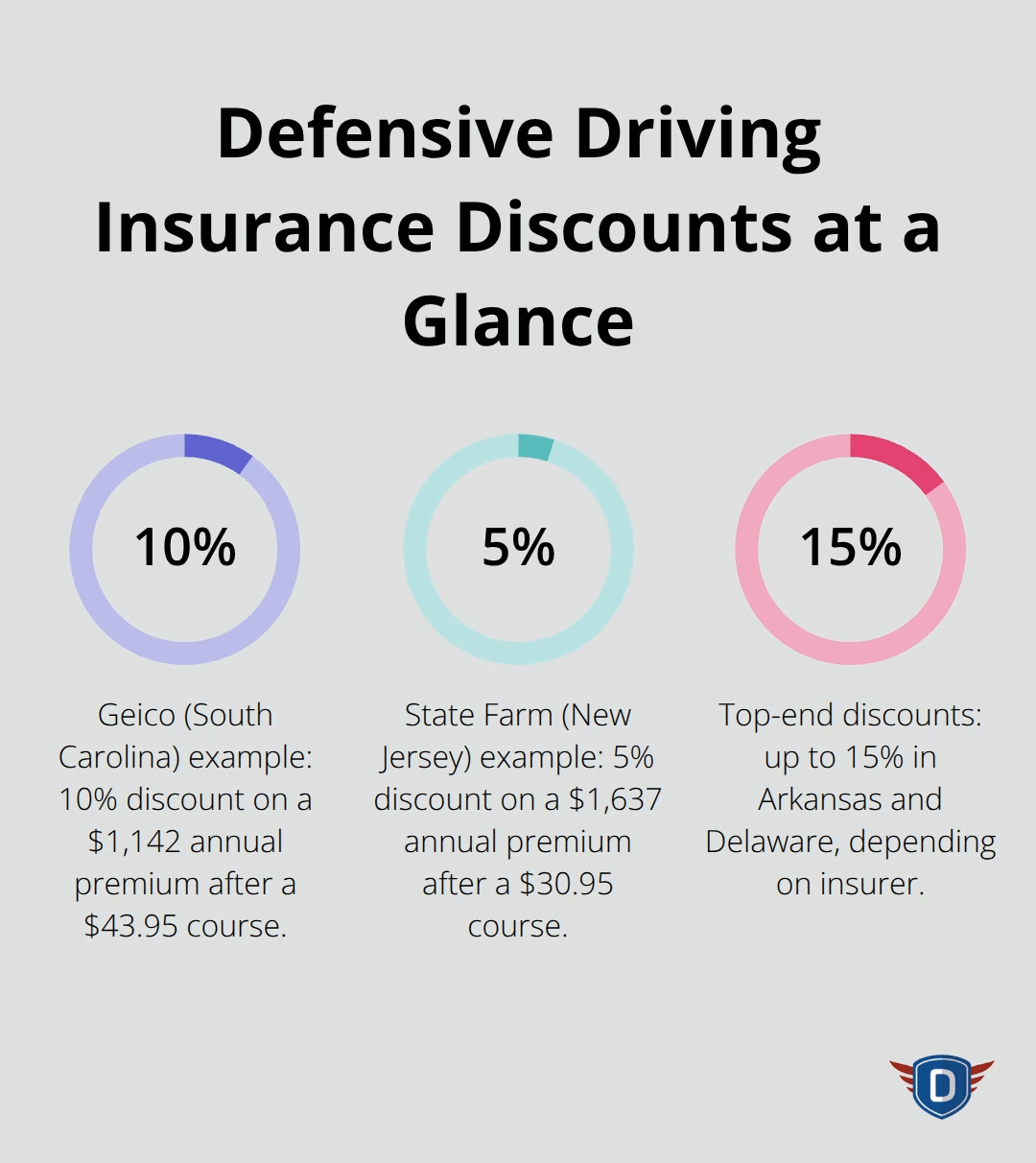

Real Savings From Insurance Discounts

A Geico customer in South Carolina paid $43.95 for a course and received a 10% discount on a $1,142 annual premium, saving $114.20 per year and recouping the course cost in roughly five months. State Farm in New Jersey showed similar results: a $30.95 course paired with a 5% discount on a $1,637 premium pays back in about seven months.

The discount rates vary by state and insurer, ranging from 5% in California, Connecticut, and New Jersey up to 15% in Arkansas and Delaware, so your actual savings depend on where you live and your current premium.

Long-Term Financial Impact

After 24 months of accumulated discounts, you gain hundreds of dollars beyond the initial course cost, making the upfront investment negligible if your insurer participates. This financial advantage compounds over time, which is why understanding your specific state’s discount structure matters before you enroll. Your next step involves identifying which providers your insurance company actually recognizes and what discount percentage applies to your policy.

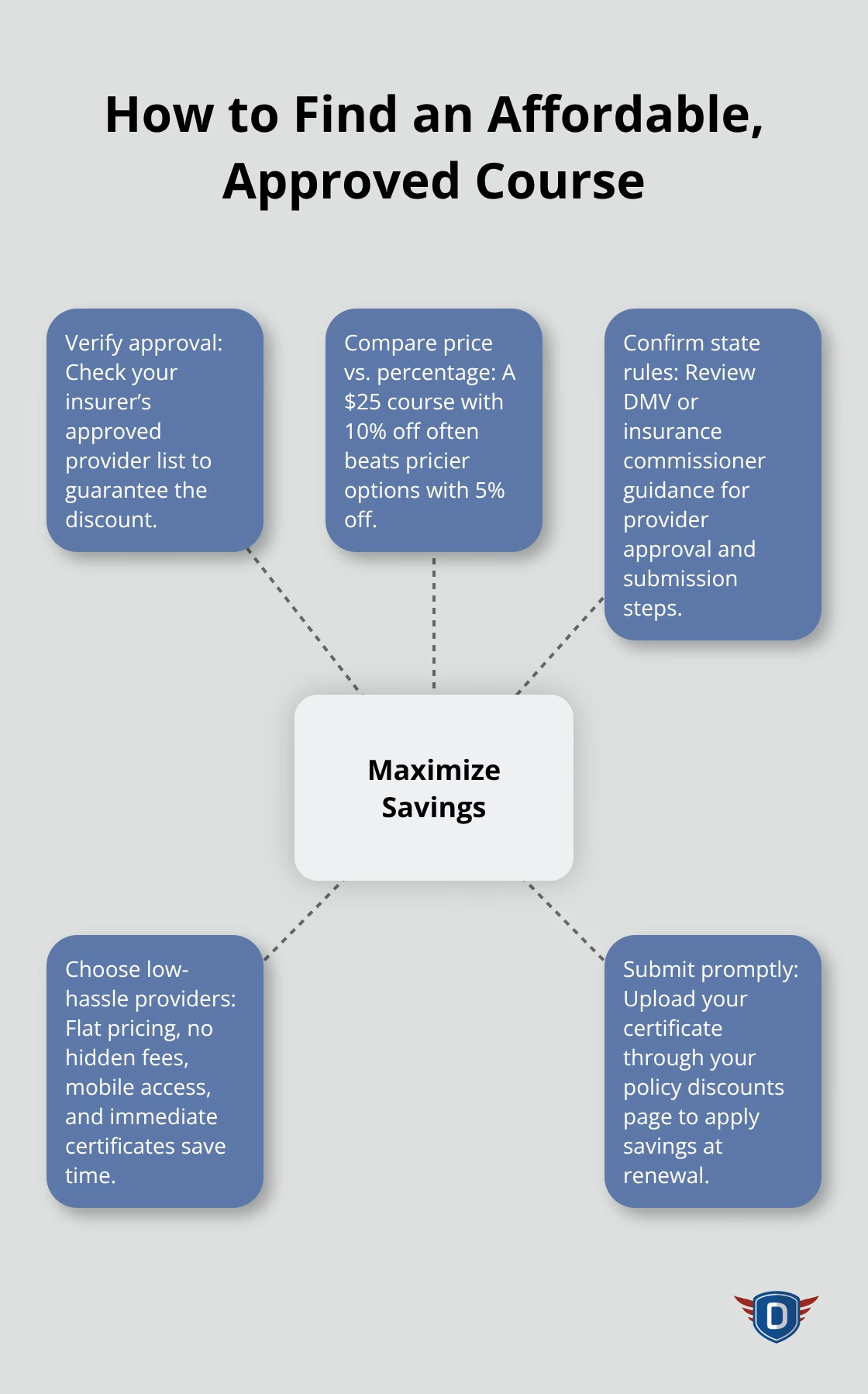

Where to Find Affordable Courses

Insurance companies actively partner with specific course providers to offer verified discounts, and you must identify your insurer’s approved list to guarantee savings. Geico recognizes courses from Defensive Driving by IMPROV, the National Safety Council, and the American Safety Council, with discount rates ranging from 5% to 15% depending on your state. State Farm, Allstate, and other major carriers maintain their own approved provider networks-logging into your policy or calling your agent reveals exactly which courses qualify for your specific discount. Taking an unapproved course wastes your money because you’ll pay the course fee without receiving the insurance reduction that justifies the expense.

Most insurers allow you to submit your completion certificate online through your policy’s discounts page, and the savings apply immediately to your next renewal.

Verify Your Insurer’s Approved Providers

Your insurance company’s website or customer service line provides the complete list of recognized course providers. This step prevents costly mistakes and ensures your completion certificate actually triggers the discount you expect. Different insurers partner with different providers, so what works for your neighbor’s Geico policy may not work for your State Farm coverage. Calling your agent takes five minutes and eliminates all guesswork about eligibility.

Compare Pricing Against Discount Percentages

State and regional variations create opportunities to shop strategically rather than accepting the first option you find. Delaware’s $14.95 bottom-tier pricing contrasts sharply with Wisconsin’s $96.95, yet both states offer legitimate approved providers. A $25 course paired with a 10% discount on your premium qualifies you for insurance savings-far superior to a course with only a 5% discount on the same premium. This calculation prevents you from overpaying for premium-branded options that deliver identical legal and insurance outcomes as budget alternatives. Your insurer’s discount percentage matters more than the course provider’s reputation or marketing claims, so verify that detail before enrolling anywhere.

Navigate State-Specific Requirements

Some states like New York require submitting certificates through the New York DMV’s accident prevention course list, while others handle everything between you and your insurer without state involvement. Checking your state’s official DMV or insurance commissioner website reveals the complete list of approved providers and submission procedures. Payment flexibility rarely exists in the defensive driving market since most providers operate on simple one-time fees, but understanding your state’s rules prevents delays in receiving your discount.

Choose Providers That Eliminate Hassle

DriveSafe Online maintains a flat $24.95 pricing model with no hidden fees, mobile compatibility, and immediate certificate delivery via email, making it a straightforward option when your insurer recognizes their provider status. For Florida drivers, floridadetscourse.com offers Florida-approved traffic school programs designed to meet FLHSMV requirements while positioning you for insurance discounts. Our platform delivers BDI, IDI, and specialized courses in English, Spanish, and Portuguese, with certificates reported directly to the state, eliminating the submission hassle entirely. This direct reporting to state authorities means you avoid the extra step of manually submitting paperwork to qualify for your insurance reduction.

The next step involves calculating your actual payback timeline based on your specific premium and discount rate, which reveals whether the course investment makes financial sense for your situation.

Hidden Costs and Money-Saving Tips

Most defensive driver courses advertise a single price and deliver exactly that with no surprises, but some providers hide expenses that inflate your actual spending. Certificate processing fees, state reporting charges, and mandatory document submissions can add $10 to $30 onto your initial course cost, turning a $25 course into a $50+ expense if you don’t read the fine print. DriveSafe Online eliminates this problem entirely by including the completion certificate in their flat $24.95 price with immediate email delivery, meaning no additional fees appear later.

Understand What Happens After You Complete the Course

When you evaluate course providers, demand transparency about what happens after you finish the course-specifically whether certificate delivery costs extra and whether the provider handles state reporting or if you must submit paperwork yourself. Some states require you to physically mail certificates or upload them through your DMV account, which costs nothing but demands your time and attention. Other states like Florida have providers report certificates directly to the Florida Department of Highway Safety and Motor Vehicles, eliminating the submission step entirely and ensuring your insurance discount processes without delay.

Calculate Your Break-Even Point Before Enrolling

The real money-saving strategy involves calculating your break-even point before enrolling in any course, which reveals whether the investment actually makes financial sense for your situation. A $25 course with a discount on your insurance on a $1,200 annual premium can save between 5% to 20%, meaning you could recover the course cost quickly and pocket significant savings within the first 12 months. However, the exact savings depend on your insurer’s specific discount percentage and your actual premium amount.

Avoid the Biggest Financial Mistake

This calculation exposes why shopping based solely on course price is financially reckless-your state’s discount percentage and your actual premium amount matter far more than choosing the cheapest provider. Drivers with higher premiums experience faster payback; a $60 course becomes irrelevant when your insurance discount generates substantial annual savings. The worst mistake involves enrolling in an unapproved course from a provider your insurer doesn’t recognize, which means you pay the full course fee and receive zero insurance reduction.

Verify Approval Before You Spend Money

Verify your insurer’s approved provider list before spending any money, then cross-reference that list with your state’s requirements to confirm the course qualifies legally and financially.

Final Thoughts

Defensive driver course costs range from $15 to $97 depending on your state, but your actual defensive driver course cost depends on three factors: your location, your insurer’s approved providers, and the discount percentage your state allows. The cheapest course means nothing if your insurance company doesn’t recognize it, so you must verify approval before enrollment to prevent wasting money on an unapproved provider. A $25 course paired with a 10% insurance discount on a $1,200 annual premium recovers its cost in just three months, then generates ongoing savings for years.

Drivers with higher premiums benefit most from completing a course because the discount percentage applies to a larger base amount, creating faster payback and greater total savings. A driver paying $2,000 annually saves $200 with a 10% discount, making even a $100 course worthwhile. Conversely, drivers with lower premiums should prioritize finding the cheapest approved option since their absolute savings will be modest regardless of discount percentage.

Beyond the insurance discount, you gain knowledge about safe following distances, distraction management, and hazard recognition that reduces your actual crash risk. The course teaches techniques that prevent accidents entirely, which protects your safety and avoids the hidden costs of collisions, medical expenses, and increased premiums from at-fault claims. Visit floridadetscourse.com to explore Florida-approved traffic school programs that fit your needs and budget.