Car insurance premiums hit record highs in 2024, with the average driver paying $1,895 annually according to Bankrate data. Smart drivers are turning to defensive driving for insurance reduction to combat these rising costs.

At floridadetscourse.com, we’ve seen firsthand how proper defensive driving education can slash insurance bills by 5-15% while making roads safer for everyone.

Understanding Defensive Driving and Insurance Discounts

What Qualifies as Defensive Driving Training

Insurance companies recognize specific defensive driving programs that meet state-approved standards and demonstrate measurable risk reduction. The National Safety Council offers courses that mature drivers who successfully complete may qualify for reduced insurance premiums, while AARP Smart Driver programs have trained over 20 million drivers and maintain acceptance across most insurance providers. State-approved online courses through organizations like the American Safety Council also qualify, provided they include at least 4-6 hours of instruction that covers hazard recognition, distance calculations, and emergency response techniques.

How Insurance Companies Calculate Risk and Premiums

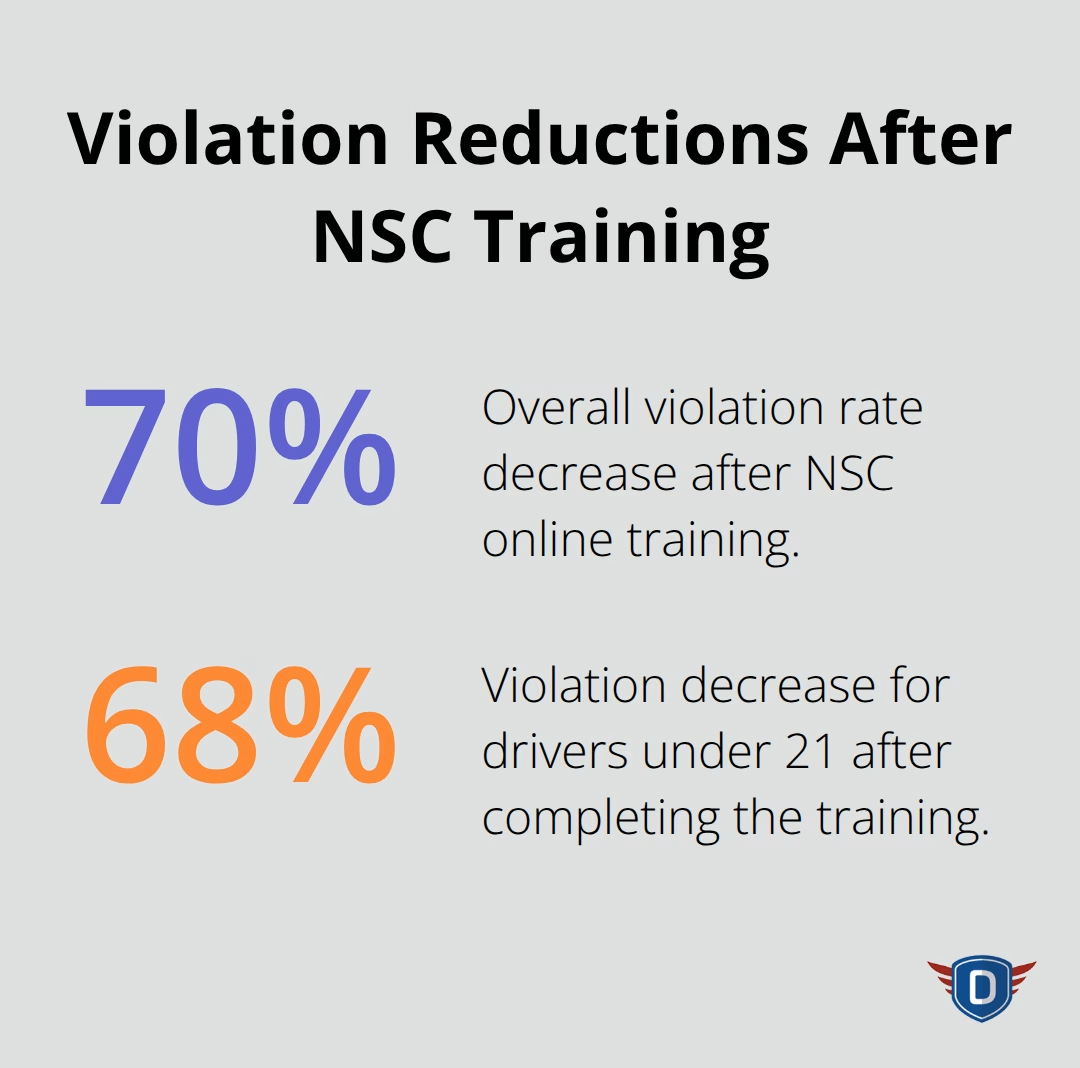

Insurance companies use actuarial data that shows NSC online training leads to a 70% decrease in violation rates. Drivers under 21 years old achieved a 68% decrease in violations after completing the training.

Progressive and State Farm track specific metrics (hard brakes, speed violations, and collision frequency) to determine premium adjustments. Insurers assign point values to violations, with defensive certification typically removing 2-4 points from your record depending on state regulations.

Average Savings from Defensive Driving Courses

Texas drivers save up to 10% annually on premiums after completion of state-approved defensive courses, which translates to $150-200 yearly savings on average policies. Florida residents see 5-15% reductions, with some insurers like Allstate offering combined discounts that reach 25% when defensive training pairs with good driver programs. The Insurance Information Institute reports defensive discounts average $233 annually nationwide, with savings that last 3-5 years for drivers who maintain clean records. PEMCO’s data shows their My Discount program offers up to 20% reductions for drivers who demonstrate consistent defensive techniques through telematics monitoring (though privacy concerns exist).

These substantial savings make defensive courses an attractive investment, but the real value comes from the specific techniques and skills you’ll learn to reduce your risk profile on the road.

Proven Defensive Techniques That Cut Insurance Costs

Advanced Following Distance Rules

The National Safety Council found that proper following distance prevents 29% of rear-end collisions, but their traditional three-second rule fails in real-world conditions. Smart drivers apply extended following distances based on conditions. At highway speeds, this creates roughly 240 feet between vehicles.

Speed management extends beyond posted limits. Insurance telematics data shows drivers who maintain speeds within 5 mph of traffic flow experience 40% fewer accidents than those who vary significantly from surrounding vehicles. This consistency signals lower risk to insurance algorithms.

Master Active Visual Scanning

Professional drivers scan their mirrors every 5-8 seconds and check blind spots before any lane change. This technique reduces side-impact crashes by 31% according to Federal Motor Carrier Safety Administration studies. Your eyes must move constantly, checking the road 12-15 seconds ahead while you maintain peripheral awareness.

Effective scanning involves three zones: immediate (0-4 seconds ahead), intermediate (4-12 seconds), and advanced (12-15 seconds). Insurance companies track eye movement patterns through some telematics programs, rewarding drivers who demonstrate consistent scanning behaviors.

Weather-Specific Risk Reduction

Weather conditions demand specific adjustments that insurance companies track through telematics. Wet roads require doubled following distances and speeds reduced by 10-15 mph below posted limits. The Federal Highway Administration reports that 23% of crashes are weather-related.

Snow and ice demand more dramatic changes. Successful defensive drivers reduce speeds by 25-40% and increase following distances to 8-10 seconds. These measurable behaviors directly correlate with lower risk scores in insurance algorithms and translate to premium reductions.

These techniques form the foundation of risk reduction, but maximizing your insurance savings requires strategic course selection and proper documentation with your provider.

Maximizing Your Insurance Savings Through Defensive Driving

Choosing the Right Course for Maximum Discounts

State Farm accepts defensive driving certificates from the National Safety Council and AARP Smart Driver programs, but rejects courses shorter than four hours or those lacking state approval. GEICO provides discounts between 5 and 15 percent for courses that include telematics integration, while Allstate requires specific curriculum elements including hazard perception and emergency response training.

Online courses from the American Safety Council cost $25-35 but deliver identical discounts to classroom versions that charge $75-125. The Insurance Information Institute confirms that courses with interactive simulations and video-based scenarios leverage Artificial Intelligence to deliver comprehensive safety education, aiming to reduce accidents and promote responsible driving.

Documentation That Gets Results

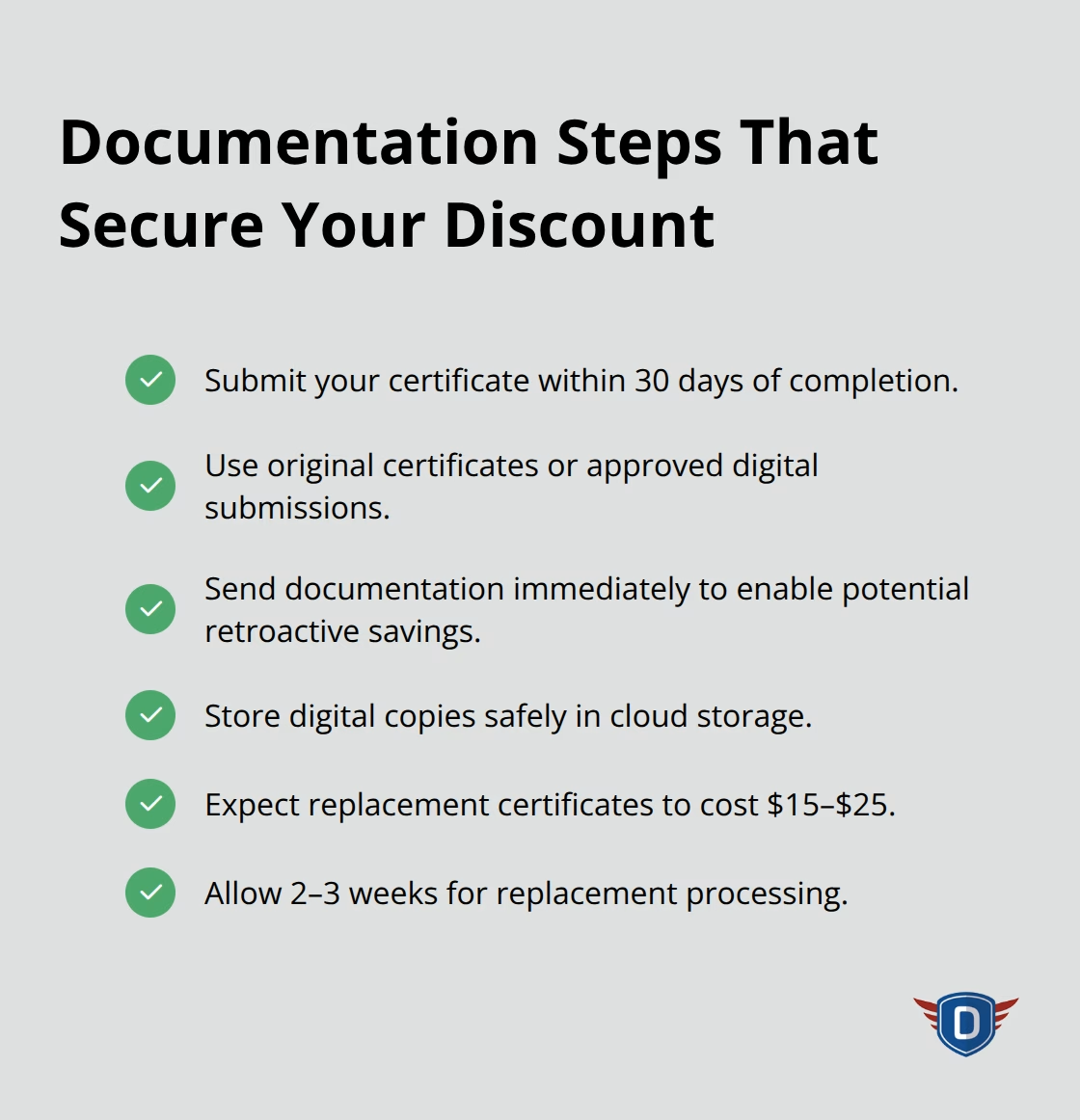

Insurance companies demand certificates within 30 days of course completion, and many reject expired or photocopied documentation. Progressive requires original certificates with raised seals, while State Farm accepts digital certificates through their mobile app.

Submit your certificate immediately after completion because some insurers apply discounts retroactively to your policy start date (potentially refunding premiums). AARP graduates receive lifetime access to updated materials, which helps maintain discount eligibility during policy renewals. Keep digital copies in cloud storage since replacement certificates from course providers cost $15-25 and take 2-3 weeks to process.

Stacking Discounts for Maximum Savings

Smart drivers combine defensive driving discounts with good driver programs to reach 25-30% total reductions. PEMCO offers their My Driving Discount alongside defensive training discounts, creating potential savings of $465 annually on average policies.

Bundling auto and home insurance with companies like Allstate while maintaining defensive certification can push total discounts beyond 35%. Multi-car policies see additional benefits when all drivers complete accident prevention courses, with some insurers offering family completion bonuses worth extra 5% reductions (making the investment even more worthwhile for households with multiple vehicles).

Final Thoughts

Defensive driving for insurance reduction creates financial benefits that compound over years rather than months. Drivers who maintain clean records after certified course completion see their discounts renewed for 3-5 years, which produces cumulative savings of $700-1,200 over time. The Insurance Information Institute shows these educated drivers file 40% fewer claims, preventing rate increases that typically follow accidents.

The safety impact extends beyond personal finances into community protection. NHTSA research confirms that defensive techniques prevent approximately 60% of preventable crashes, which protects families and reduces societal costs. Professional drivers who complete advanced courses report 68% fewer violations and significantly improved confidence in challenging conditions.

Smart drivers choose quality education programs that focus on practical skills rather than basic theory. floridadetscourse.com offers comprehensive driver education with certified instructors who teach essential techniques for sustained insurance savings. Their programs help students master defensive skills while creating the foundation for long-term road safety (and lower premiums).

![Defensive Driving for Insurance Reduction [Save Money]](https://floridadetscourse.com/wp-content/uploads/emplibot/defensive-driving-for-insurance-reduction-hero-1762657688.avif)