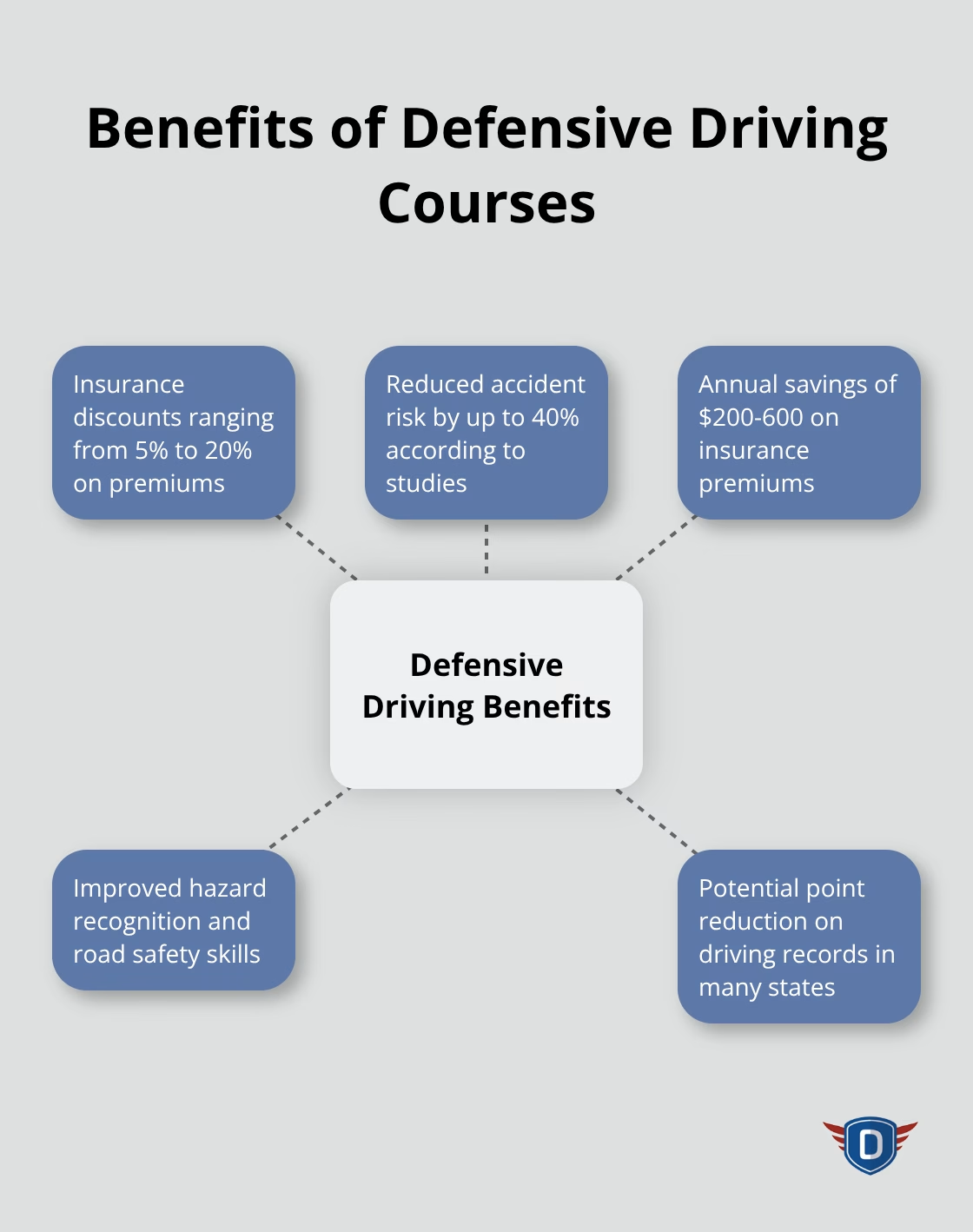

Car insurance companies reward safe drivers with significant discounts, and defensive driving courses offer one of the most direct paths to lower premiums. Studies show that drivers who complete these programs reduce their accident risk by up to 40%.

We at floridadetscourse.com see firsthand how a car insurance discount for defensive driving can save drivers hundreds of dollars annually while building lifelong safety skills.

How Does Defensive Driving Cut Your Insurance Costs

Defensive drivers transform from reactive participants into proactive road strategists who spot hazards before they develop. The National Safety Council defines this approach as constant awareness combined with speed and space control around your vehicle. These techniques rest on three core principles: safe following distances, threat scanning, and adaptation to road conditions.

Insurance Company Discount Programs

Insurance companies monitor defensive driving course graduates closely, and the data validates their investment. GEICO encourages defensive driving courses for discounts, while AAA delivers up to 15% savings for members. The National Highway Traffic Safety Administration reports that 40,901 Americans died in car accidents in 2023, which makes these prevention programs valuable to insurers.

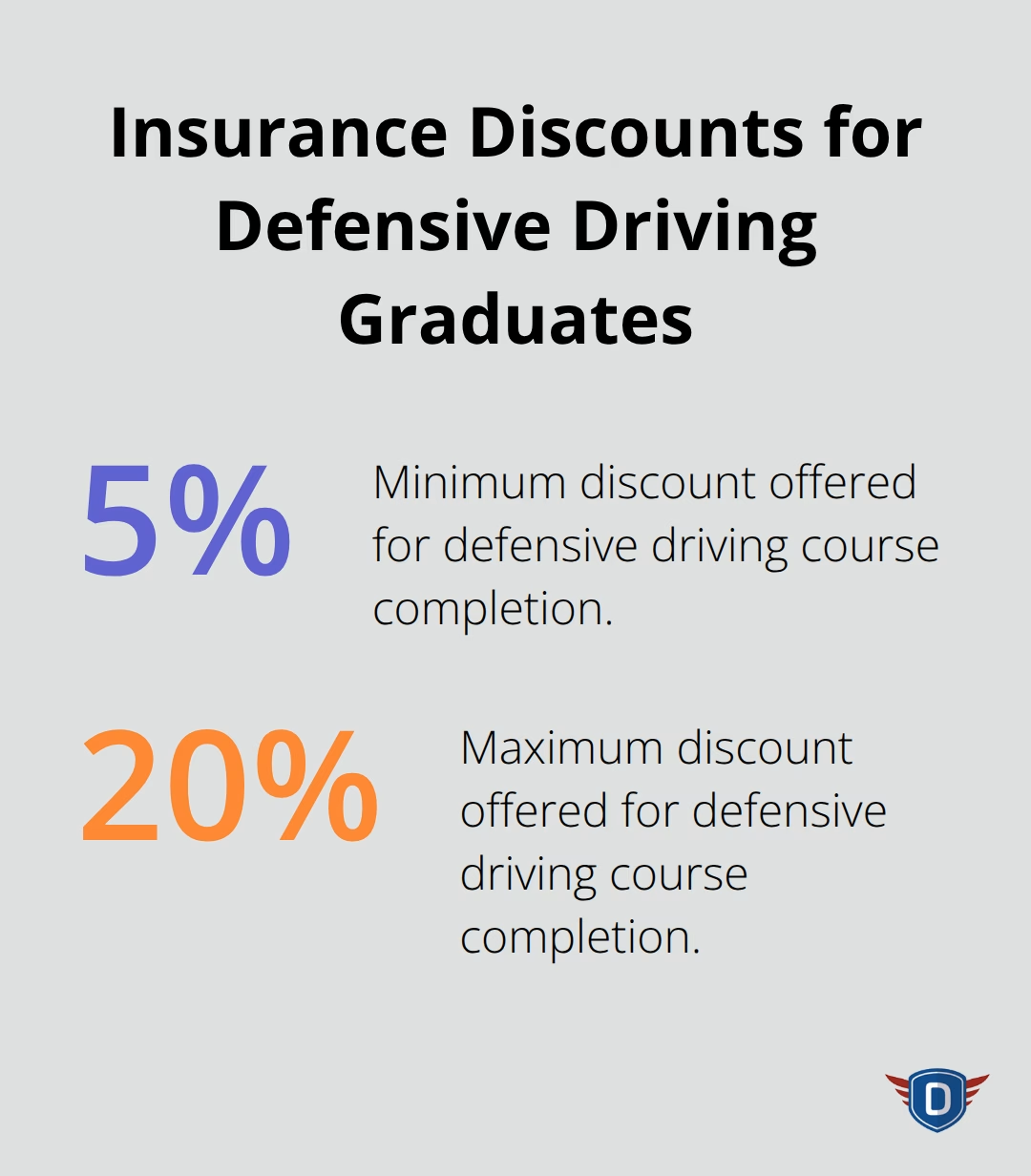

Thirty-seven states require insurance discounts for defensive driving graduates, with savings from 5% to 20% based on your provider and age. Drivers under 25 typically receive higher discount percentages due to their elevated risk profiles (since younger drivers statistically cause more accidents).

Course Structure and Certification

State-approved programs demand 4-8 hours of instruction through online or in-person formats. The National Safety Council has trained over 80 million drivers since it launched the first defensive driving course in 1964. AARP’s Smart Driver program maintains a 4.0-star rating from participants and costs between $20-40 nationwide.

Course completion certificates require direct submission to your insurance company, and most discounts apply for three years before renewal becomes necessary. Some insurers like Lemonade automatically apply discounts when they receive course completion notification (which streamlines the process for busy drivers).

Point Reduction Benefits

Many states allow point removal from driving records when drivers successfully complete defensive driving courses. This dual benefit reduces both insurance premiums and license suspension risks. The Insurance Institute for Highway Safety recognizes these programs as effective tools for safer driving habits, which creates additional value beyond immediate cost savings.

These comprehensive benefits set the foundation for understanding specific techniques that maximize your insurance savings potential.

Which Defensive Driving Skills Cut Insurance Costs Most

The Three-Second Rule and Speed Control

Proper following distance using the three-second rule prevents the majority of rear-end collisions, which are a significant portion of all traffic accidents according to the National Highway Traffic Safety Administration. This technique requires drivers to pick a fixed object ahead and count the seconds between when the lead vehicle passes it and when they reach the same point. Drivers should extend this to six seconds during rain or snow conditions, as wet roads increase stopping distances by up to 50%. Speed management goes beyond posted limits – defensive drivers reduce speed by 10-15 mph below posted limits in construction zones and school areas, where accident rates spike 40% higher than regular roadways.

Hazard Recognition and Scanning Patterns

Professional drivers scan their environment every 8-12 seconds using a systematic pattern that covers mirrors, blind spots, and potential conflict zones. The U.S. Department of Transportation found that half of traffic injuries occur at intersections, which makes intersection approach the highest-priority scan area. Drivers must watch for pedestrians who step into crosswalks without warning, vehicles that run yellow lights, and cars that make sudden lane changes without signals. Distracted drivers cause 3,142 deaths annually according to the National Highway Traffic Safety Administration, so drivers who identify phone users and aggressive drivers avoid accidents more effectively.

Weather Adaptation Strategies

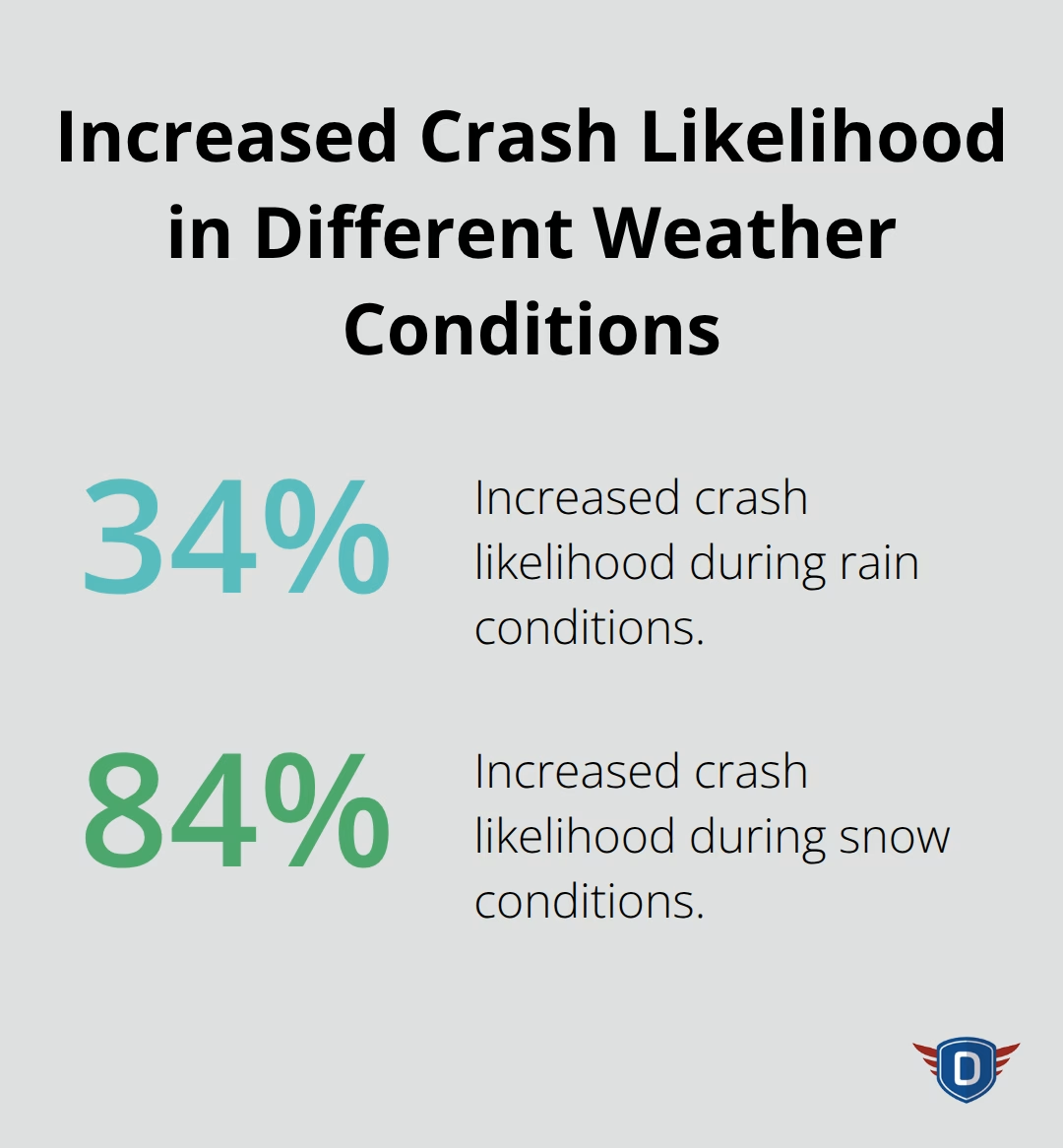

Adverse weather conditions multiply accident risks exponentially, with rain that increases crash likelihood by 34% and snow by 84% based on Federal Highway Administration data. Drivers should reduce speed by 25% during light rain and 50% during heavy downpours, as hydroplanes occur at speeds above 35 mph on wet surfaces. Headlights during any precipitation improve visibility by 60% for other drivers. Winter conditions demand monthly tire pressure checks, since cold temperatures reduce pressure by 2 PSI for every 10-degree temperature drop (which directly affects traction and stops).

These proven techniques form the foundation that insurance companies evaluate when they determine your discount eligibility and certification requirements.

How Do You Get Certified for Insurance Discounts

State-Approved Course Provider Selection

Insurance companies accept certificates only from state-approved defensive driving programs, which requires drivers to verify course eligibility before enrollment. The American Safety Council and National Safety Council offer programs in all 50 states, while AAA provides courses specifically for members. State DMV websites maintain current lists of approved providers, and courses cost between $20-40 nationwide.

Online programs dominate the market with 24/7 availability, though some states like Texas require in-person attendance for certain violations. AARP Smart Driver courses achieve the highest completion rates at 94%, compared to 78% for generic online providers according to the Insurance Institute for Highway Safety.

Certificate Submission Process

Course completion generates a certificate within 24-48 hours for online programs, while in-person classes issue certificates immediately. Insurance companies require the original certificate or digital copy with course completion date, provider name, and your full name that matches your policy exactly.

For GEICO customers, you can contact customer service to submit your certificate and inquire about processing times, while State Farm takes 10-14 days for manual review. Drivers must submit certificates within 60 days of completion to maintain eligibility (and some insurers like Progressive automatically apply discounts when they receive electronic notification from approved course providers).

Discount Maintenance Requirements

Defensive driving discounts expire after three years in most states, which requires course retaking for continued savings. Drivers with traffic violations or at-fault accidents during the discount period lose eligibility immediately, and insurance companies perform annual driving record checks.

NSC Defensive Driving courses deliver leading-edge content to train drivers to avoid collisions and crashes. Course providers send renewal reminders 90 days before expiration, and early completion prevents coverage gaps that could increase premiums by 15-25% according to industry data (making timely renewal a smart financial decision).

Final Thoughts

Defensive driving courses deliver measurable financial returns through insurance discounts that range from 5% to 20%, with drivers who save $200-600 annually on premiums. The National Safety Council’s data shows these programs reduce accident risk by 40%, which creates compound savings through lower claims and maintained good driver status. The benefits extend far beyond immediate cost reduction as drivers develop enhanced hazard recognition skills that protect families and reduce stress during daily commutes.

The Insurance Institute for Highway Safety confirms that course graduates maintain cleaner driving records for years after completion. This translates to sustained premium advantages and improved license status that compound over time. Most insurers process certificates within two weeks, and discounts typically last three years before renewal becomes necessary (making the investment worthwhile for most drivers).

Your car insurance discount for defensive driving journey starts with selection of a state-approved course provider and completion of 4-8 hours of instruction. We at floridadetscourse.com provide comprehensive driver education programs that help students master essential skills. Our approach focuses on creation of lifelong safe driving habits that build the foundation for sustained insurance savings and road safety excellence.